The auto manufacturers industry plays a crucial role in the global economy, manufacturing vehicles that meet the diverse transportation needs of individuals and businesses worldwide.

As an investor, understanding this industry is essential for identifying the best auto stocks for long term that have the potential to generate substantial returns.

In this article, we will explore various aspects of the auto manufacturers industry and provide insights into factors to consider when investing in stocks within this sector.

Additionally, we will discuss economic factors, technological advancements, competitive landscape, investment strategies, financial analysis, and the importance of staying updated with industry trends.

Let’s delve into each of these topics in detail and go through the best automotive stocks list.

Understanding The Auto Manufacturers’ Industry

The auto manufacturers industry comprises companies involved in the design, development, manufacturing, and sale of automobiles.

This industry includes a wide range of players, from large multinational corporations to smaller regional manufacturers.

Auto manufacturers produce vehicles such as cars, trucks, SUVs, and motorcycles, catering to different customer segments and markets.

-

Key Players and Market Share

The auto manufacturers industry is highly competitive, with several key players dominating the market.

Companies like Toyota, Volkswagen, General Motors, Ford, and BMW are considered industry giants, with a significant market share.

These companies have global operations and a wide product portfolio, enabling them to reach various markets and cater to diverse customer preferences.

-

Vehicle Segments and Market Dynamics

The auto industry comprises passenger cars, commercial vehicles, and motorcycles, each with distinct characteristics.

Passenger cars dominate the industry revenue, while commercial vehicles are crucial for logistics, and motorcycles cater to unique consumer needs.

Market dynamics are shaped by consumer preferences, economy, and technology, prompting manufacturers to adjust product strategies based on evolving demands.

-

Global And Regional Market Trends

The auto industry’s growth is influenced by global and regional trends.

Global trends, such as the rising demand for electric vehicles and government incentives, impact the industry worldwide.

Regional trends, like vehicle preferences and regulations, also shape the market.

Economic factors, consumer behaviors, and cultural shifts further impact auto manufacturers, requiring them to adapt and stay competitive.

-

Regulatory Environment and Policy Changes

The auto industry navigates a complex regulatory landscape. Governments worldwide set rules on safety, emissions, fuel efficiency, and trade.

Regulatory changes have a big impact, like stricter emissions standards prompting technology investments. Trade policies and tariffs affect costs and global market access.

Auto manufacturers must monitor regulations to comply and adapt.

Factors To Consider When Investing In Auto Manufacturers Stocks

Investing in the best auto stocks for long term requires careful consideration of various factors.

Factors such as market trends, company financials, technological advancements, government regulations, consumer demand, and competitive landscape play a crucial role.

Additionally, assessing management strength, production efficiency, brand reputation, and industry stability is vital.

Diligent research and analysis of these factors help make informed investment decisions in the ever-evolving auto manufacturing sector.

Economic Factors Affecting the Industry

-

Global Economic Outlook and Consumer Spending

The auto manufacturers industry is significantly influenced by the global economic outlook and consumer spending patterns.

During economic expansions, consumers tend to have higher disposable incomes and are more likely to purchase vehicles.

Conversely, during economic downturns, consumer spending on big-ticket items like cars may decrease.

-

Interest Rates and Inflation

Interest rates and inflation rates are crucial economic factors that affect the auto manufacturers industry.

Higher interest rates increase borrowing costs for consumers, potentially reducing their purchasing power and impacting vehicle sales.

Inflation can also affect the industry by increasing production costs, including raw materials and labor expenses.

-

Government Policies and Trade Regulations

Government policies and trade regulations have a significant influence on the auto manufacturers industry.

These policies can include emissions standards, fuel economy regulations, safety requirements, and tax incentives for electric vehicles.

Changes in government policies and regulations can create opportunities or challenges for auto manufacturers.

-

Consumer Confidence and Buying Patterns

Consumer confidence and buying patterns play a vital role in the auto manufacturing industry.

When consumers have a positive economic outlook and feel confident about their financial situation, they are more likely to make significant purchases, such as vehicles.

Conversely, low consumer confidence can lead to reduced demand.

-

Currency Fluctuations and International Markets

Currency fluctuations and international markets can affect the auto manufacturers industry, especially for companies with global operations.

Exchange rate volatility can impact profitability, manufacturing costs, and competitiveness in international markets.

Additionally, economic conditions and regulatory environments in different countries can influence the demand for vehicles.

Technological Advancements and Innovation

-

Electric And Hybrid Vehicles

One of the significant technological advancements in the auto manufacturers industry is the development and adoption of electric and hybrid vehicles.

Electric vehicles (EVs) are powered by electricity and produce zero emissions, making them more environmentally friendly than traditional internal combustion engine vehicles.

Hybrid vehicles combine an internal combustion engine with an electric motor, offering improved fuel efficiency and reduced emissions.

-

Autonomous Driving and Artificial Intelligence

Autonomous driving technology, enabled by artificial intelligence (AI), is revolutionizing the auto manufacturers industry.

Self-driving cars have the potential to enhance road safety, improve transportation efficiency, and redefine the concept of personal mobility.

-

Connectivity And Internet of Things (IoT)

Connectivity and the Internet of Things (IoT) are transforming vehicles into sophisticated connected platforms.

Features such as in-car infotainment systems, advanced driver assistance systems, and vehicle-to-vehicle communication are becoming increasingly prevalent.

-

Advanced Manufacturing Processes

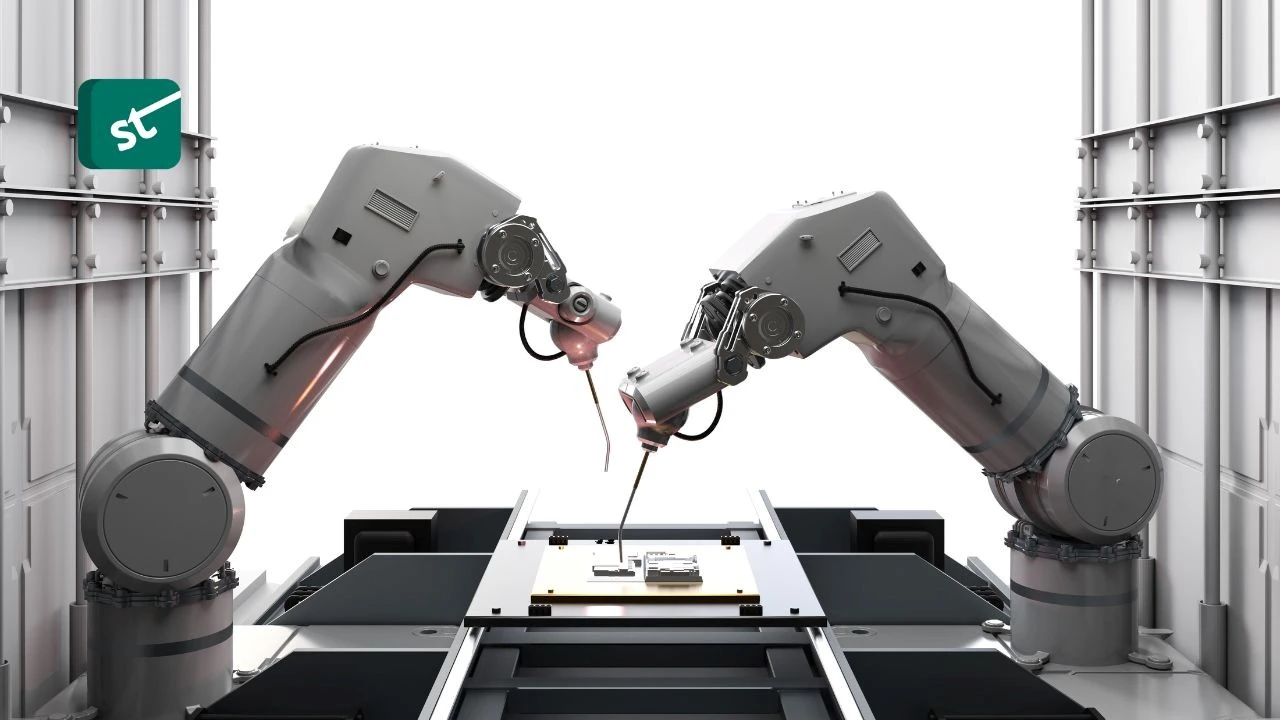

Advancements in manufacturing processes, such as automation, robotics, and 3D printing, are improving efficiency and reducing production costs for auto manufacturers.

These technologies allow for faster and more precise production, customization options, and waste reduction.

-

Battery Technology and Infrastructure

As electric vehicles gain popularity, advancements in battery technology become crucial.

Improvements in battery capacity, charging speed, and cost-effectiveness are key factors that drive the widespread adoption of EVs.

Additionally, the development of charging infrastructure, including fast-charging stations and battery-swapping services, is critical for the growth of electric mobility.

-

Mobility-As-A-Service (MaaS) And Shared Mobility Solutions

The concept of Mobility-as-a-Service (MaaS) is gaining traction, enabling consumers to access transportation services on-demand rather than owning a vehicle.

Shared mobility solutions, such as ride-hailing, car-sharing, and subscription-based services, are becoming increasingly popular.

Competitive Landscape and Market Positioning

-

Key Competitors and Market Share Analysis

Analyzing the competitive landscape and market share of auto manufacturers is essential for investors.

-

Brand Reputation and Customer Loyalty

Brand reputation and customer loyalty are critical factors for auto manufacturers’ success.

Strong brands often command higher customer loyalty and can influence purchasing decisions.

-

Product Portfolio and Innovation Pipeline

The product portfolio and innovation pipeline of auto manufacturers plays a significant role in their competitive advantage.

Investors should evaluate a company’s ability to introduce new models, innovative features, and technology advancements.

A robust product portfolio and a strong innovation pipeline indicate a company’s commitment to meeting changing customer demands and staying ahead of competitors.

-

Sales And Distribution Channels

Sales and distribution channels are crucial for reaching target markets and generating revenue.

Auto manufacturers use various channels, including company-owned dealerships, third-party dealerships, e-commerce platforms, and partnerships with rental or ride-hailing companies.

-

Market Entry Barriers and Industry Consolidation

The auto manufacturers industry has significant entry barriers, including high capital requirements, complex manufacturing processes, and extensive distribution networks.

Additionally, industry consolidation through mergers and acquisitions can impact market dynamics and competition.

-

Emerging Markets and Expansion Opportunities

Emerging markets present growth opportunities for auto manufacturers, as rising incomes and increasing urbanization drive demand for vehicles.

Investors should evaluate a company’s presence in emerging markets, its market share, and its expansion strategies.

Successful penetration of emerging markets can contribute to long-term growth and profitability.

30 Stocks to Bet On

Investing in the auto manufacturers industry can be a promising venture. These companies are innovative electric vehicle makers and established global automakers.

They emerged as market leaders, efficient supply chain managers, and companies embracing autonomous technology.

These best auto stocks for long term investing have strong fundamentals, a track record of innovation, and a commitment to sustainability.

Here is a ten best performing automotive stocks list that shows potential.

-

Tesla, Inc.

First on our list of best performing auto stocks is Tesla, Inc. (TSLA), a market leader with a massive market cap of $854.38 billion.

TSLA has performed remarkably well, with significant gains in the past month (46.23%), a quarter (33.32%), and YTD (113.85%).

The current price is $263.42, reflecting its strong market dominance.

-

Ford Motor Company

Ford Motor Company (F) is next on the list of 10 best performing auto stocks which boasts a substantial market cap of $57.01 billion.

It has shown positive performance with gains in the past month (20.76%), quarter (20.04%), and YTD (27.09%).

The current price stands at $14.07, highlighting its stability and growth potential.

-

Li Auto Inc.

Third in our best performing auto stocks list is Li Auto Inc. (LI) which has a market cap of $35.11 billion.

The company has displayed impressive performance with positive gains in the past month (19.82%), quarter (48.19%), and YTD (70.93%).

Its current price of $34.87 and strong performance make it the right pick.

-

XPeng Inc.

XPeng Inc. (XPEV) is the next best performing auto stocks, with a market cap of $9.57 billion.

XPEV has demonstrated decent performance, albeit with modest gains in the past month (18.79%), a quarter (8.12%), and YTD (7.80%).

Its performance in recent months to the current price of $10.72 is suggesting potential for further growth.

-

General Motors Company

Another big name in best performing auto stocks is General Motors Company (GM) with a market cap of $51.98 billion.

GM has shown positive performance with gains of 13.98% in the past month and 6.06% in the quarter, although YTD performance has been relatively flat at 10.66%.

Currently priced at $37.23, GM also has the potential to remain in best performing auto stocks.

-

NIO Inc.

The Chinese giant NIO Inc. (NIO) with a market cap of $16.44 billion also stands tall among best performing auto stocks.

NIO has exhibited a positive performance of 13.20% in the past month, but the quarterly performance of -1.46% has been slightly negative.

Although its YTD performance is also dropped by -6.13% at the current price of $9.14, the stock is still in a better position in the market.

-

Sono Group

Next of the best performing auto stocks is Sono Group (SEV). With a market cap of $25.41M, SEV has shown strong performance with a 66.27% increase in the past month.

However, its quarter and YTD performance are negative at -34.45% and -71.26% respectively, indicating challenges.

But at the current price of $0.28, it could be consider for its future potential.

-

Hyzon Motors Inc.

With a market cap of $187.77M, Hyzon Motors Inc. (HYZN) is next in best performing auto stocks.

While its monthly performance is positive at 52.93%, the company has faced challenges in the quarter (-29.75%) and YTD (-52.41%), resulting in negative performance.

The current price of $0.74 and better performance in the last 30 days are showing the potential of the stock in coming weeks.

-

Electrameccanica Vehicles Corp.

Another of best performing auto stocks is Electrameccanica Vehicles Corp. (SOLO).

With a market cap of $88.51M, SOLO has performed well, with positive gains of 62.98% in the past month.

Its quarterly performance of 39.51% and year-to-date performance of 34.98% with the current price of $0.81 are showcasing its potential in the market.

-

LiveWire Group, Inc.

Last but not least, LiveWire Group, Inc. (LVWR) is also among best performing auto stocks. LVWR has a significant market cap of $2.19 billion.

The company has exhibited impressive performance with substantial gains of 57.65% in the past month, 72.46% in the quarter, and 127.22% YTD.

The current price stands at $11.02, reflecting its strong market position.

We have also compiled a best performing automotive stocks list of 20 more companies to consider.

These best auto stocks for long term investment have strong potential for growth and are worth considering for your portfolio.

| No | Ticker | Company | Market Cap

(in million) |

Perf (Month) | Perf (Qtr) | Perf (YTD) | Price |

| 1 | PSNY | Polestar Automotive Holding UK PLC | 8045.18 | 11.01% | 1.39% | -31.64% | 3.63 |

| 2 | HMC | Honda Motor Co., Ltd. | 56746.41 | 10.69% | 22.27% | 36.55% | 31.22 |

| 3 | TM | Toyota Motor Corporation | 258408.02 | 10.55% | 15.80% | 15.12% | 157.23 |

| 4 | RIVN | Rivian Automotive, Inc. | 15104.34 | 9.47% | 8.34% | -19.99% | 14.74 |

| 5 | FFIE | Faraday Future Intelligent Electric Inc. | 319.36 | 8.98% | -52.30% | -16.36% | 0.24 |

| 6 | AYRO | Ayro, Inc. | 25.24 | 8.61% | 15.07% | 71.41% | 0.66 |

| 7 | PTRA | Proterra Inc. | 292.17 | 8.12% | -23.80% | -66.45% | 1.26 |

| 8 | WKHS | Workhorse Group Inc. | 178.96 | 4.14% | -32.87% | -38.61% | 0.93 |

| 9 | RACE | Ferrari N.V. | 55528.55 | 3.60% | 15.88% | 44.23% | 308.97 |

| 10 | NIU | Niu Technologies | 344.66 | 2.09% | 11.39% | -20.55% | 4.16 |

| 11 | VEV | Vicinity Motor Corp. | 39.61 | 1.05% | 3.78% | -10.54% | 0.86 |

| 12 | NWTN | NWTN Inc. | 2971.5 | 1.03% | 10.91% | 0.47% | 10.78 |

| 13 | STLA | Stellantis N.V. | 52788.65 | 0.63% | -3.07% | 18.91% | 16.89 |

| 14 | GP | GreenPower Motor Company Inc. | 70.64 | 0.00% | 22.48% | 54.34% | 2.67 |

| 15 | EVTV | Envirotech Vehicles, Inc. | 30.97 | -13.82% | -29.33% | -0.47% | 2.12 |

| 16 | PEV | Phoenix Motor Inc. | 15.71 | -2.89% | 2.56% | -24.53% | 0.8 |

| 17 | CENN | Cenntro Electric Group Limited | 92.68 | -10.91% | -30.71% | -33.18% | 0.29 |

| 18 | FSR | Fisker Inc. | 1978.03 | -11.35% | -5.69% | -24.76% | 5.47 |

| 19 | ARVL | Arrival | 36.11 | -12.24% | -72.14% | -72.05% | 2.23 |

| 20 | BLBD | Blue Bird Corporation | 672.21 | -18.48% | 7.40% | 105.88% | 22.05 |

Investment Strategies and Tips for Auto Manufacturers Stocks

Investment in auto manufacturers’ stocks requires careful analysis and understanding of market dynamics.

Long-term prospects depend on factors like technological advancements, industry trends, and global demand.

Investors should consider factors like financial stability, research and development investments, and competitive positioning.

Additionally, monitoring regulatory changes, consumer preferences, and environmental concerns is vital.

Diversification, patience, and regular evaluation of performance are keys to successful investment in best auto stock to buy now.

Diversification and Portfolio Allocation

-

Sector Allocation and Risk Management

Diversification across sectors is important for managing risk in an investment portfolio.

Auto manufacturers stocks can be part of a broader sector allocation strategy, where investors allocate only a percentage of their portfolio to the automotive sector among others.

This diversification helps mitigate the impact of industry-specific risks and market fluctuations and help investors to bet on some of the best auto stock to buy now.

-

Investing In Related Industries and Supply Chain

Investors may consider investing in related industries and companies within the auto manufacturers’ supply chain.

This can include manufacturers of auto components, technology providers, or companies involved in raw material production.

Investing in related industries can provide exposure to different aspects of the automotive ecosystem and diversify risk.

-

Geographic Diversification

Geographic diversification is crucial when investing in auto manufacturers stocks, as the industry is global in nature.

Investors can consider companies with diverse geographic operations, targeting both developed and emerging markets.

This approach helps mitigate risks associated with specific regional economic conditions, regulatory changes, or geopolitical events.

-

Asset Allocation and Portfolio Rebalancing

Investors should determine the appropriate allocation of auto manufacturers stocks within their overall investment portfolio based on their risk tolerance and investment goals.

Asset allocation refers to the distribution of investments across different asset classes, such as stocks, bonds, and cash equivalents.

Additionally, investors should periodically rebalance their portfolios to maintain the desired asset allocation and adjust for changes in market conditions or individual stock performance.

-

Consideration of Market Cycles

Auto manufacturers stocks are influenced by market cycles and economic conditions.

Investors should be aware of the different phases of the economic cycle, such as expansion, contraction, recession, or recovery, and adjust their investment strategy accordingly.

For example, during economic expansions, auto manufacturers may experience increased demand, while during economic downturns, demand may decline.

Understanding market cycles can help investors make informed decisions about when to enter or exit investments in the industry.

Analyzing Financial Statements and Performance Indicators

-

Income Statement Analysis

Income statement analysis involves evaluating a company’s revenue, expenses, and profitability.

Comparing these metrics to industry benchmarks and competitors can provide insights into a company’s competitive position and profitability.

-

Balance Sheet Analysis

Balance sheet analysis focuses on a company’s assets, liabilities, and shareholders’ equity.

A strong balance sheet indicates a company’s ability to meet its short-term and long-term obligations and withstand economic downturns.

-

Cash Flow Statement Analysis

Cash flow statement analysis provides insights into a company’s cash inflows and outflows from operating activities, investing activities, and financing activities.

Positive cash flow and effective cash management indicate a company’s ability to generate cash, reinvest in its business, and return value to shareholders.

-

Key Financial Ratios and Metrics

Investors should analyze key financial ratios and metrics to assess a company’s financial performance and health.

Comparing these ratios to industry benchmarks and historical performance can provide insights into a company’s operational efficiency, financial risk, and profitability.

-

Comparative Analysis and Industry Benchmarks

Comparative analysis involves comparing a company’s financial performance and ratios to its industry peers and benchmarks.

This analysis helps identify companies that outperform or underperform their industry peers and provides context for evaluating investment opportunities.

-

Evaluating Return on Investment (ROI) And Return on Equity (ROE)

Return on investment (ROI) and return on equity (ROE) are important metrics for assessing a company’s profitability and the returns generated for shareholders.

ROI measures the efficiency of an investment by comparing the gain or loss relative to the cost of investment.

ROE measures a company’s ability to generate profits from shareholders’ equity.

Staying Updated with Industry News and Trends

-

Trade Publications and Industry Reports

Trade publications and industry reports provide valuable insights into the auto manufacturers industry, including market trends, industry developments, and company-specific news.

-

Analyst Recommendations and Market Sentiment

Analyst recommendations and market sentiment can provide guidance and insights for investors.

Analyst reports often include research on specific companies, industry trends, and stock performance predictions.

-

Earnings Calls and Investor Presentations

Earnings calls and investor presentations provide opportunities to hear directly from company management and gain insights into their strategies, financial performance, and outlook.

These events often provide additional information that may not be available in public reports.

-

Industry Conferences and Events

Industry conferences and events bring together key stakeholders, including industry experts, executives, and investors.

Attending or following these conferences can provide access to the latest industry trends, technological advancements, and expert opinions.

-

Monitoring Regulatory Developments

Regulatory changes and policies can significantly impact the auto manufacturers industry.

Investors should stay informed about regulatory developments related to emissions standards, safety regulations, trade policies, and government incentives for electric vehicles.

These changes can influence market dynamics, production costs, and consumer demand.

-

Social Media and Online Communities

Social media platforms and online communities can be sources of real-time information, news, and discussions related to the auto manufacturers industry.

Following industry influencers, participating in relevant online communities, and engaging with discussions on social media can provide alternative perspectives.

Conclusion

Navigating the world of auto manufacturer stocks demands a profound grasp of the industry’s intricate web.

Economic fluctuations, technological breakthroughs, and competitive positioning serve as crucial pillars shaping investment decisions.

A discerning investor must analyze market trends, anticipate shifts in consumer preferences, and gauge the impact of disruptive innovations.

Diligence in monitoring supply chains, evaluating production efficiency, and assessing environmental considerations will contribute to informed choices.

Remember, successful investments in auto manufacturers hinge on a judicious blend of industry knowledge, foresight, and adaptability.

By staying attuned to the ever-evolving landscape, one can seize opportunities from our best automotive stocks list.

It can also drive them towards profitable outcomes in the realm of the best auto stock to buy now.

Frequently Asked Questions

What Are the Key Factors to Consider When Selecting Auto Manufacturers Stocks for Investment?

When selecting auto manufacturers stocks for investment, key factors to consider include market demand for their vehicles.

Other factors include competitive position, financial health, technological innovation, environmental sustainability, regulatory compliance, and global expansion plans.

Supply chain resilience, management expertise, and the ability to adapt to emerging trends such as electric and autonomous vehicles could also weigh on stock performance.

How Do Economic Factors, such as GDP Growth and Interest Rates, Affect the Auto Manufacturers Industry?

Economic factors like GDP growth impact the auto manufacturers industry by influencing consumer purchasing power and demand for vehicles.

Higher GDP growth often means increased disposable income, leading to higher car sales. Interest rates affect auto loans, impacting affordability and consumer borrowing decisions.

Both factors significantly shape the industry’s profitability and sales performance.

Are Electric Vehicles a Good Investment Opportunity Within the Auto Manufacturers Industry?

Electric vehicles (EVs) present a promising investment opportunity in the auto manufacturers industry.

The global push for sustainability and government incentives has propelled their demand.

EV technology advancements, expanding charging infrastructure, and declining battery costs further boost their appeal.

With a growing market and potential for future dominance, investing in EVs can yield favorable returns for astute investors.