Options trading can be a highly profitable and exciting endeavor. It allows market participants to engage in strategic speculation while systematically managing their risk exposure and attempting to maximize the gains they make. One of the most popular and effective options strategies is the strangle option, which involves buying both a call option and a put option on the same underlying asset with the same expiration date but different strike prices.

The strangle option has been used by professional traders and investors for decades, and in recent years, it has gained popularity among individual investors as well.

It is a versatile strategy that can be used in a variety of market conditions, including bull, bear, and neutral markets. However, it requires a deep understanding of options trading and a disciplined approach to risk management.

Whether you are a seasoned options trader or just starting out, this article will provide you with the knowledge and skills you need to successfully implement the strangle strategy and take your trading to the next level.

What Is A Strangle Option?

A strangle option is a tactic traders use to earn a profit, by turning to the derivative market. The strangle involves buying both a call and put option, resulting in a gain if the underlying spot price moves significantly in either the upward or downward direction.

If for instance, the underlying spot price undertakes a hard plunge, the put option will be exercised, giving the holder the right to sell the asset far higher than the market is willing to pay for it. Alternatively, the only loss incurred on the call would be the premium paid on it.

This trading strategy is known as the strangle because it has an underlying asset covered within a fixed range, between put and call, and thus has its movement narrowed.

The strangle option’s most compelling factor of appeal is the fact that the loss is limited to the premium paid for both options purchased, whereas the gain is potentially limitless.

The strangle has two primary forms which include the long strangle option and the short strangle option. The former involves buying a put and a call, as discussed above, whereas the short involves selling these two options.

How Does A Strangle Work?

In order to break down exactly how a strangle option works, we need to go over the entire process from initiation to the profit it delivers.

First, an investor buys a call option and a put option on the same underlying asset with the same expiration date, but at different strike prices. The strike price of the call is typically set above the current market price of the asset, while the strike price of the put is below it.

When the price of the underlying asset moves significantly in either direction, the investor can profit by exercising either the call or the put option, depending on the direction of the price movement. This allows for a profit opportunity in either direction the spot price moves.

If the price of the underlying asset rises above the strike price of the call option, the investor can exercise the call option and buy the underlying asset at the lower strike price. The investor can then sell the asset in the market at a higher price, realizing a profit.

Conversely, if the price of the asset falls below the strike price of the put, the investor can exercise the put option and sell the underlying asset at the higher strike price. The investor can then buy the asset in the market at a lower price, again realizing a profit.

Even if the price of the underlying asset remains stagnant, the investor can still earn a profit if the premiums received from selling the call and put options exceed the cost of buying them.

Strangle vs. Straddle Option Strategy

Like the strangle, another options strategy that is renowned among traders is the straddle option strategy, which is considered the opposite of the strangle approach.

The straddle also involves buying a call and put, but unlike in the case of the strangle options, these each have the same strike price and expiration date. This results in some crucial differences between the strangle vs. straddle option strategy.

The most notable of these differences are as follows:

-

Cost

The straddle option usually comes at a higher cost than the strangle option, primarily because it involves buying both puts and calls of the same strike price, which gives it a higher premium.

-

Risk

Although both strangles and straddles are considered risky trading strategies because of options expiry, the straddle is usually a lot riskier. This is because a high price movement can deliver a loss, based on the way the trade is structured.

-

Payoff

The payoff approach also differs significantly between straddle and strangle. In the case of the former, a profit is earned with little price movement, whereas the latter is set up when high movement in either direction is anticipated.

Real-World Example Of A Strangle

To drive the point home about the strangle option strategy we turn to an example involving real-world securities, and how they are actually used by traders in the markets.

We assume Sally is an options trader who believes that the stock for the emerging electric car company, Mullen Automotive (NASDAQ: MULN) may experience a high degree of price volatility in the immediate future. She is not sure which direction this volatility will actually take.

Because Sally expects heavy movement in either the upward or downward direction, she opts to implement the strangle option strategy to take advantage of this uncertainty, with the knowledge that MULN is currently trading at $0.20 per share.

Sally buys a call option having a strike price of $0.30 and a put option with a strike price of $0.10, both of which will be expiring in exactly 30 days. This setup has her position secured, guaranteeing a gain, independent of the direction in which the movement takes place.

If the price of MULN goes up to $0.35 per share within the 30-day period, Sally’s call option will be “in the money” and she can exercise her right to buy the stock at $0.30 per share, and then sell it on the open market for $0.35.

This move would give Sally a $0.05 gain for every share she sells, after subtracting the premium she paid for the call and put option, which she does not exercise.

Similarly, if the price of the stock falls significantly, Sally would make a gain by means of exercising her put option and selling MULN for higher than its market price.

In the event that MULN does not undertake significant movement and remains between the $0.10 and $0.30 range, neither option will be exercised, and Sally would bear the loss to the extent of the cost of the options she bought.

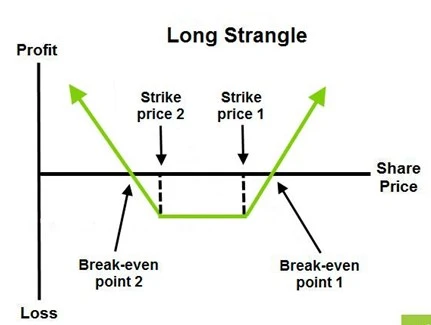

How Do You Calculate The Breakeven Of A Strangle?

The breakeven refers to the point where the profit of a particular trade is equal to the costs of setting it up. Any gain above this is welcomed by the trader, and below this is avoided.

Calculating the breakeven point of a strangle is important because it helps traders determine the price range in which the underlying asset needs to move in order for the trade to be profitable, and it can help them manage their risk by setting appropriate stop-limit orders.

Steps of Breakeven Calculation

The following steps are to be undertaken when calculating the breakeven of a strangle option:

- Determine the total premium paid for the call and put options. This would entail summing up the premiums of both call and put options.

- Determine the strike prices of the call and put options. The call would have a higher strike price than the current spot price, and the put would have a lower strike price.

- Calculate the upper breakeven point by adding the total premium to the strike price of the call option. The underlying asset would need to climb to this sum to break even in the upper range.

- Calculate the lower breakeven point by subtracting the total premium from the strike price of the put option. The underlying asset would need to drop to this sum to break even in the lower range.

The breakeven is graphically displayed in the image below:

Conclusion

The strangle option is a remarkable derivative trader’s tool that can be deployed in the market to turn in a profit. It allows one to make a gain when significant movement is expected in either the upward or downward direction.

Both the long as well as short strangle options are flipsides of the strangle approach, and involve buying and selling call and put options, respectively, with the same expiry dates.

The strangle is such a favorite among traders because it allows for potentially limitless gains above the breakeven point, while simultaneously restricting losses to the extent of the cost paid for acquiring each option.

FAQs

How Can You Lose Money On A Long Strangle?

You can lose money on a long strangle if the underlying asset’s price stays within the strike prices at expiration or if it moves in only one direction, causing one of the options to expire worthless, resulting in a loss equal to the premiums paid for the options.

Which Is Riskier: A Straddle or a Strangle?

A straddle is considered riskier than a strangle due to the higher cost of the options and the requirement for a greater price movement to generate a profit.